Analysis Category: Quarterly Analysis

Quarterly economic monitor − Q3 2023

Industrial production in the third quarter of 2023 fell to 0.8%, contrary to the previous quarter when there was an increase.

Quarterly Economic Monitor Q2 – 2019

Macedonia 2025 projects: GDP growth between 1 – 3% in q2 2019

Based on the available early warning indicators and high frequency data, we project moderate economic slowdown in North Macedonia in the second quarter of 2019.

These projections are based on following economic developments in q2 2019:

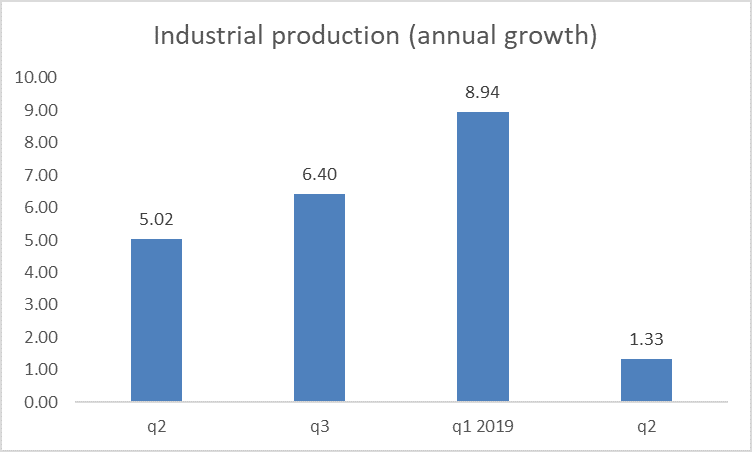

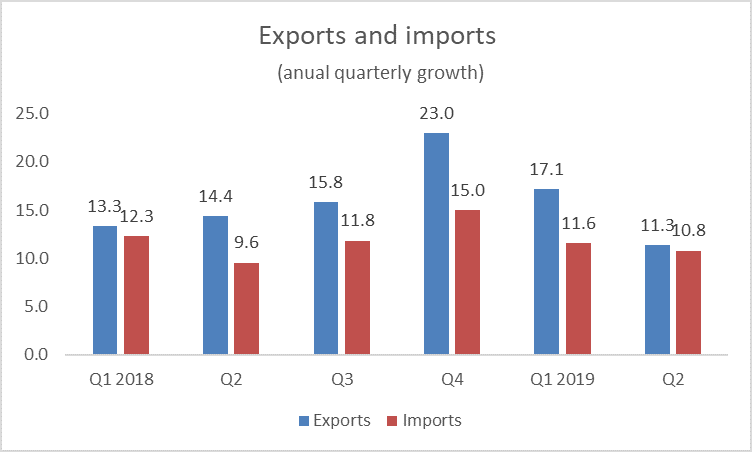

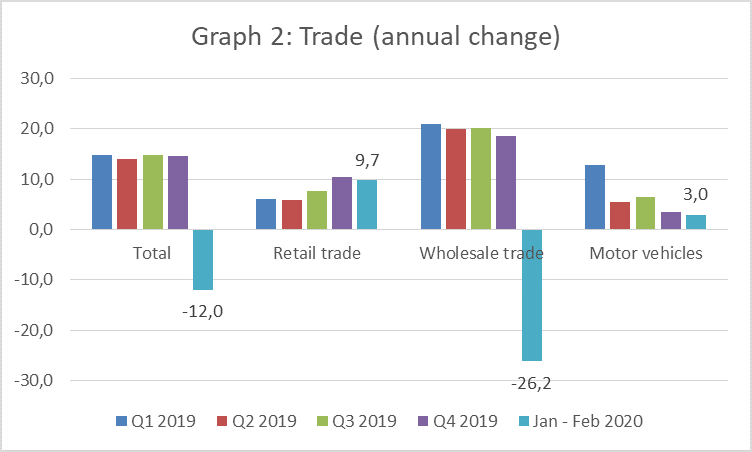

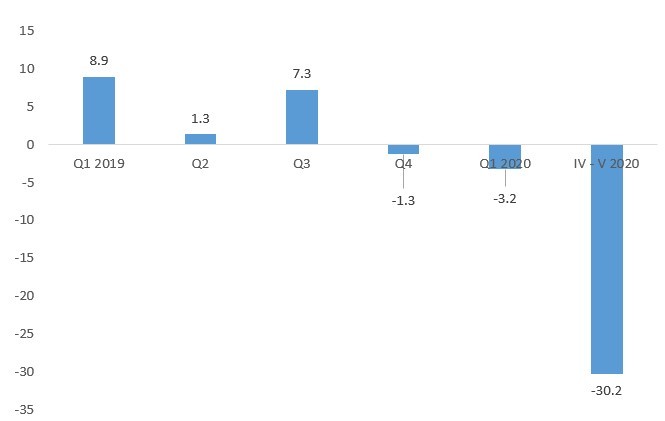

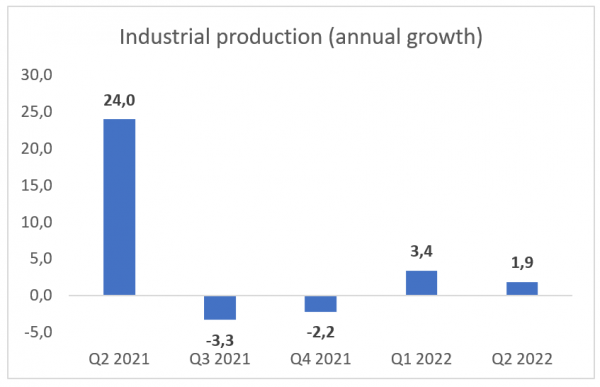

Industry: Industrial production grew moderately by only 1.3% in the second quarter of 2019. As can be seen from the chart, this represents significant slowdown compared to the previous quarters. There are two major reasons for this slowdown: Brussels imposed quotas on the metal products exports to EU from North Macedonia, as well as the decline in the car industry in Germany – the biggest North Macedonia trading partner.

Industry will have moderate impact on GDP growth in q2 2019.

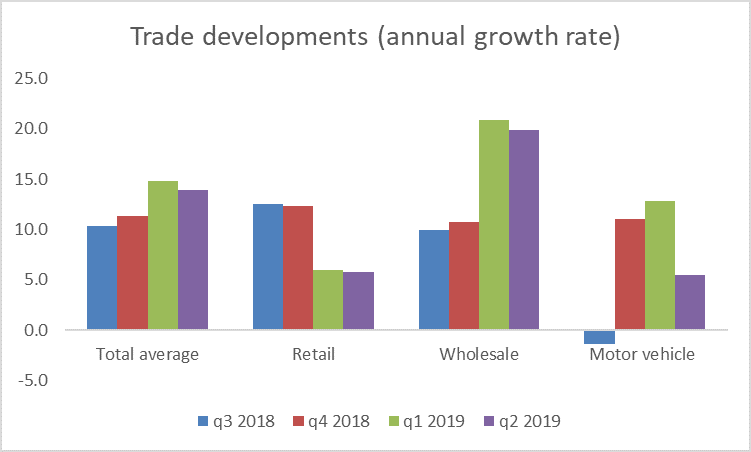

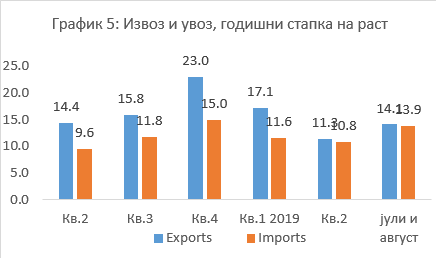

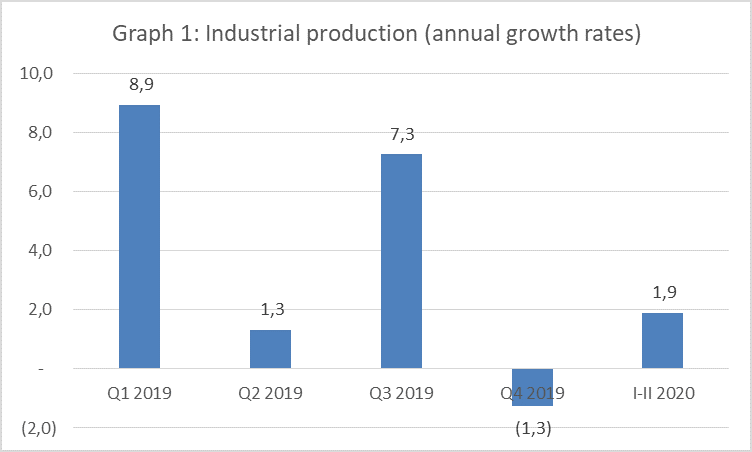

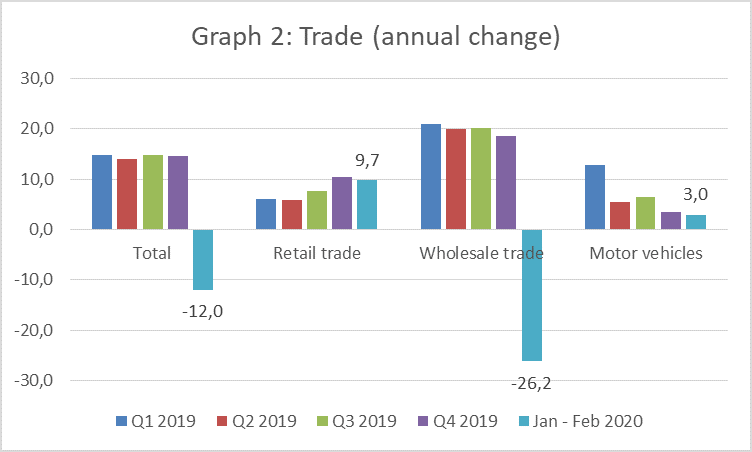

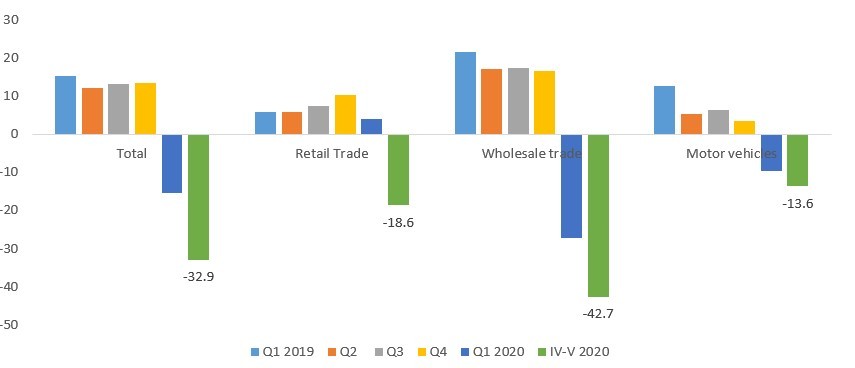

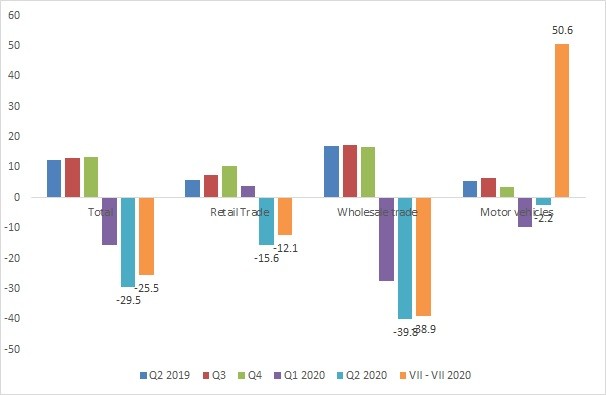

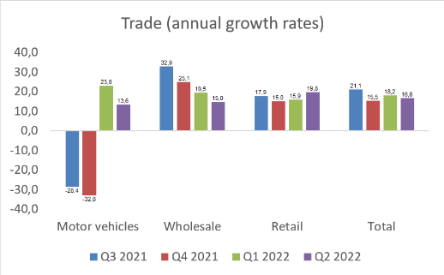

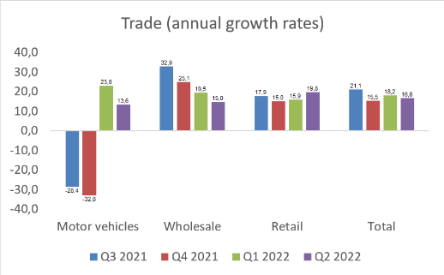

Trade: Trade developments on average are strong in q2 2019 with average annual growth rate of 13.9%. This strong trade growth is due to high wholesale growth, while retail and motor vehicle growth rates are declining. Trade developments will have strong positive impact on the GDP growth in q2 2019.

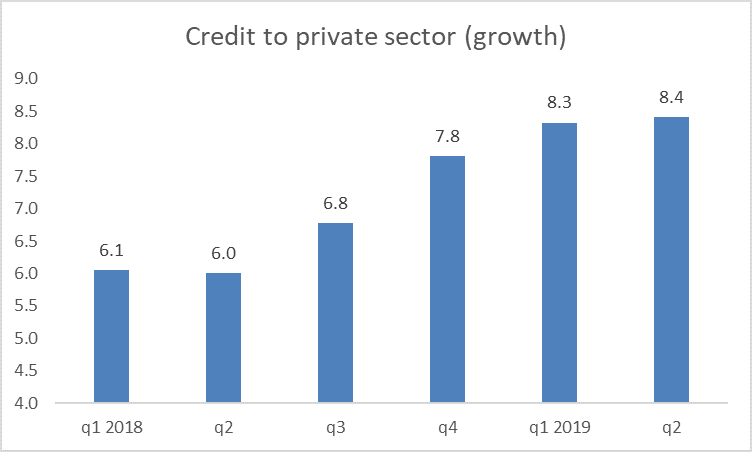

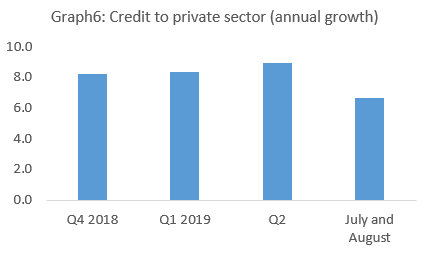

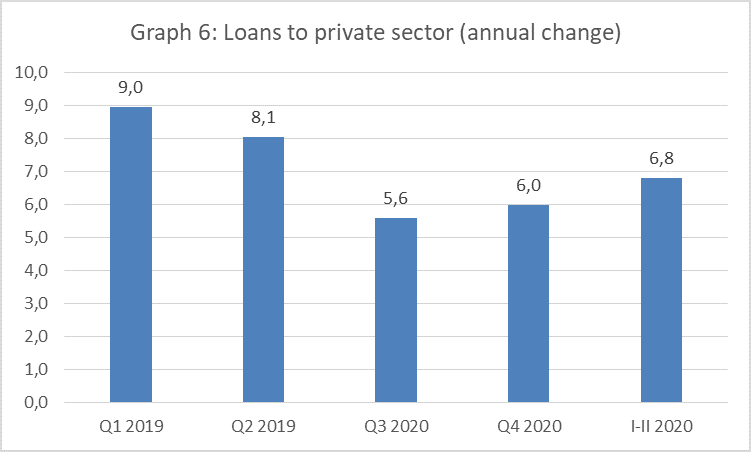

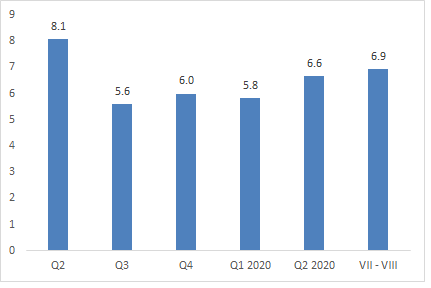

Credit to private sector growth: Strong consumption and trade are continuously fueled by strong credit to private sector growth of 8.4% in q2 2019.

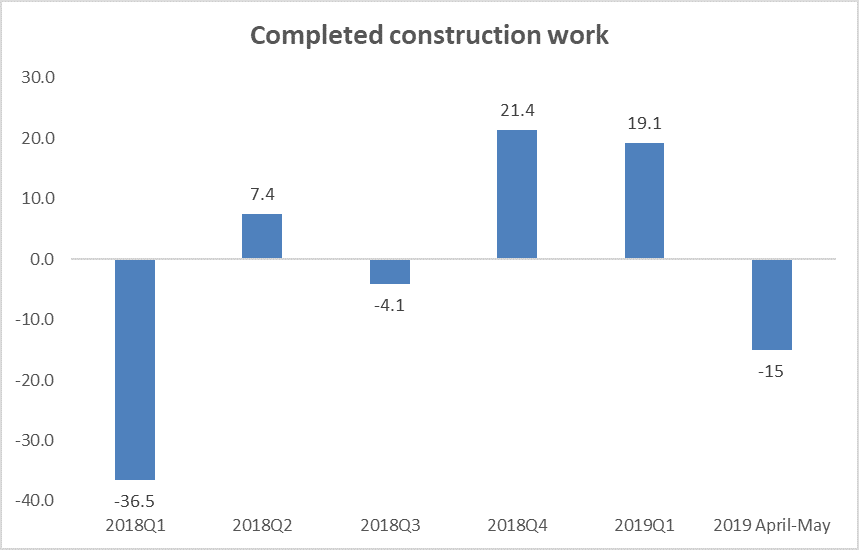

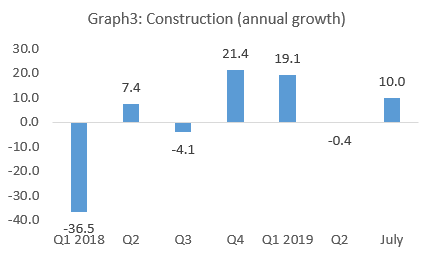

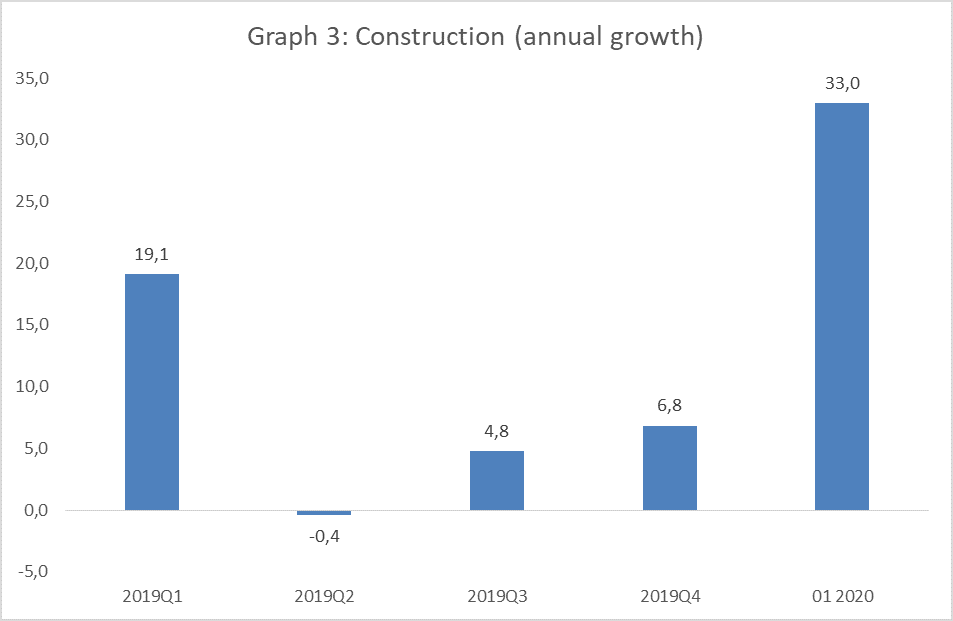

Construction: Completed construction works are showing significant decline in q2 2019. This indirectly implies that investments in q2 2019 will be very weak.

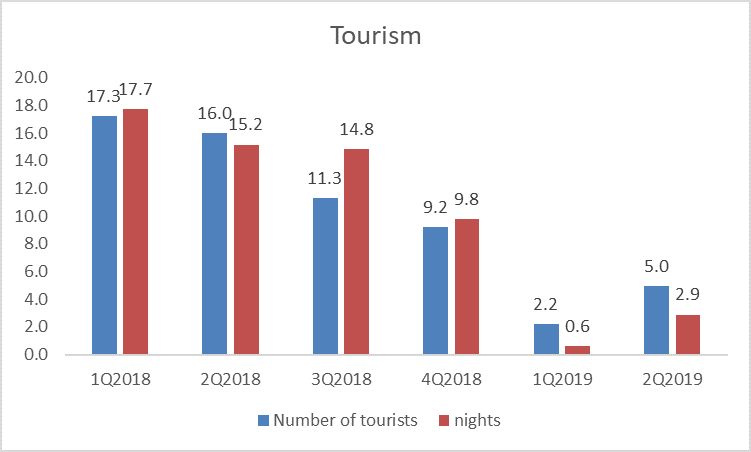

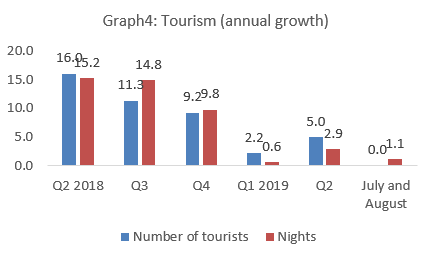

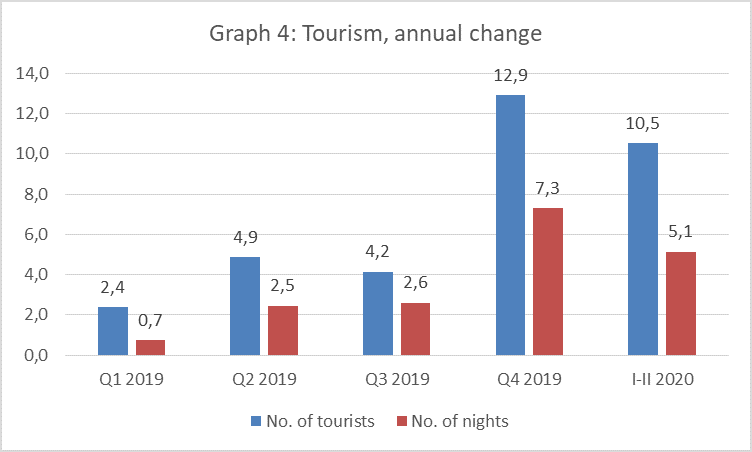

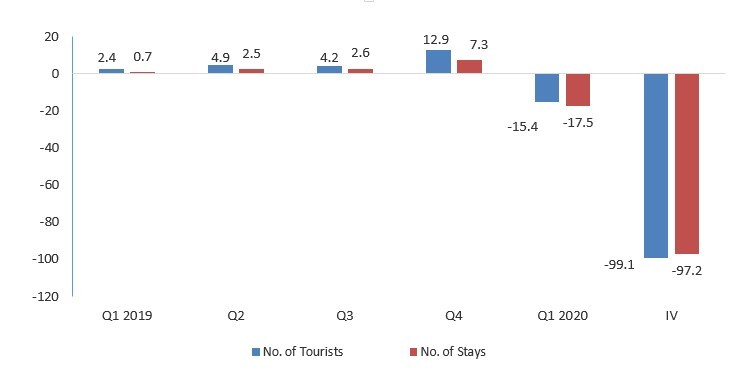

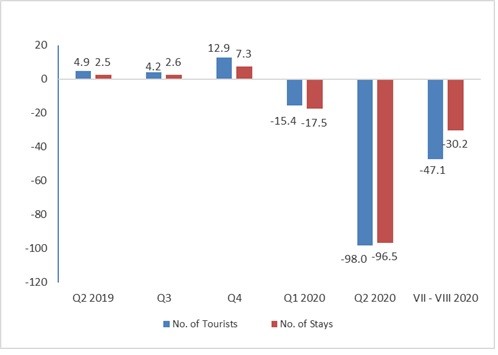

Tourism: Number of tourist in q2 2019 increased only moderately. Compared to the growth in q1 2019 there is some improvement, but the trend is still negative as can be seen from the chart. Contribution of tourism to GDP growth will be positive.

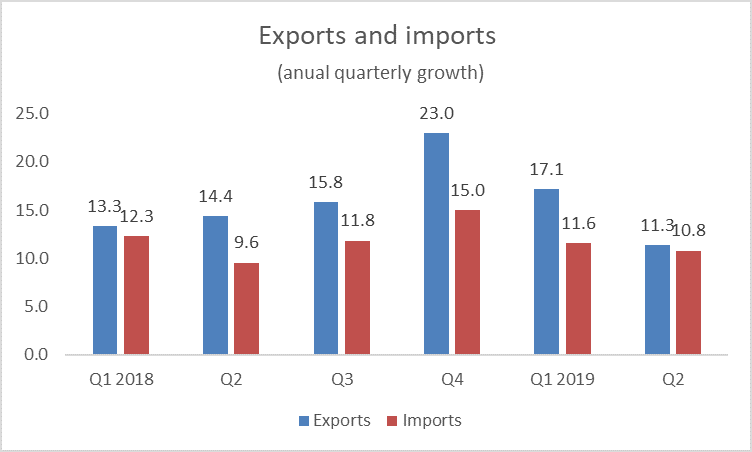

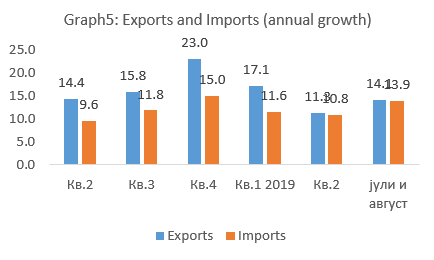

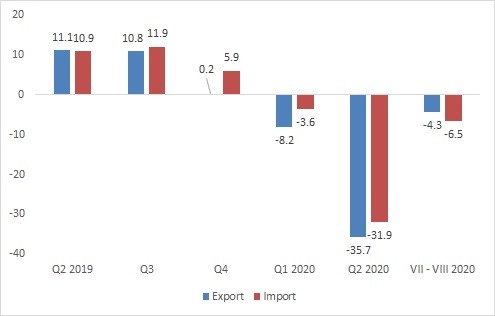

Consumption side: The exports and imports growth in q2 2019 is strong, showing that net exports will have positive impact to GDP growth. Consumption of households is contributing positive as well, while public consumption (low capital investments) and private investments will have negative impact.

Quarterly Economic Monitor Q3 – 2019

Macedonia 2025 forecast: GDP growth in Q3 2019 will be between 2.5% and 4.5%

According to the latest high frequency indicators and available data, moderate acceleration of economic growth is expected in Q3 2019, compared to the previous quarter.

The projection is due to the following economic developments in Q3 2019:

Production side:

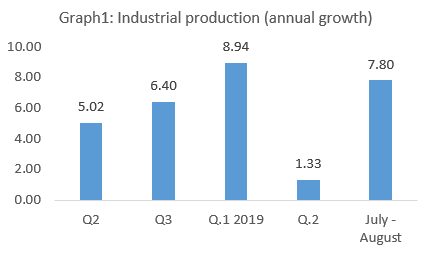

Industry: Industrial production registered a solid growth of 7.8% in the period between July and August 2019, which represents a strong positive impulse for GDP growth in Q3 2019. As can be seen in Graph 1, the growth is significantly higher compared to the growth of the previous quarter. This indicates that the deceleration of the German economy is not yet observed in the data on industrial production in the Republic of Macedonia, despite the fact that Germany is the main trading partner with a share of 48% in the total Macedonian exports (in Q2 2019). Furthermore, the EU quotas set for the Metal Industry do not have any significant impact in the analyzed period. However, industrial production risks are noticeable, especially given that most of this growth comes from the gas and water energy sector, while many other sectors are declining. In addition, industry turnover in August declined.

The industry will have a positive contribution to GDP growth in the third quarter of 2019.

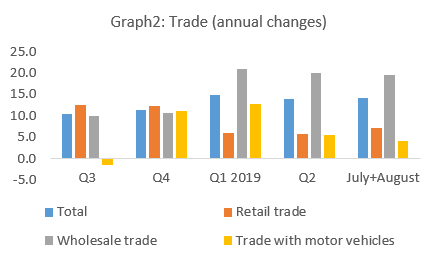

Trade: As can be seen in Graph 2, the trade continued with high growth rates in the third quarter of 2019, supported by the increase in the number of employees as well as the increase in the average paid salary in the Republic of Macedonia. Such movements were largely due to the growth of wholesale trade, while retail and motor vehicle sales recorded lower growth rates. Trends in trade will have a strong positive contribution to GDP growth.

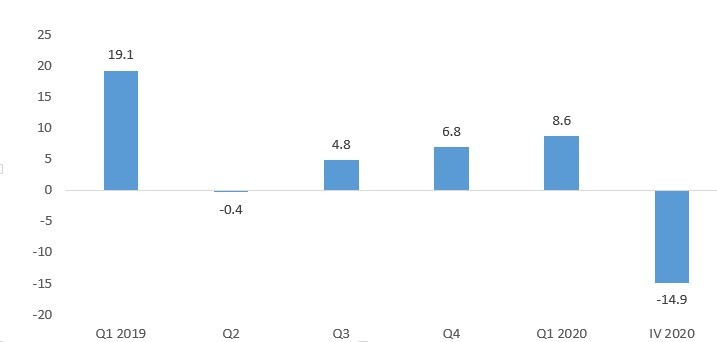

Construction: Construction completed in July 2019 experienced solid growth of 10%. Taking into account the low comparison base from the same quarter of the previous 2018 (construction in 2018 recorded negative growth rates) we expect a positive contribution of construction to GDP growth.

Tourism: Tourism in the Republic of Macedonia has a continuous decline in the number of tourists and overnight stays. The growth rates are close to zero in July-August, suggesting that tourism’s contribution to GDP growth may be insignificant in Q3 2019.

Expenditure side:

Expenditure side:

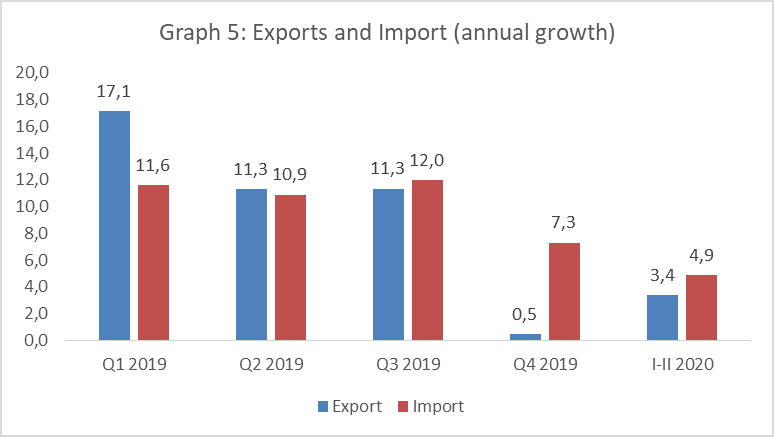

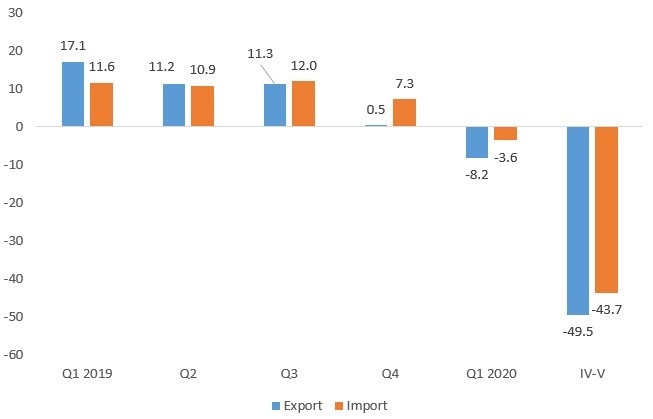

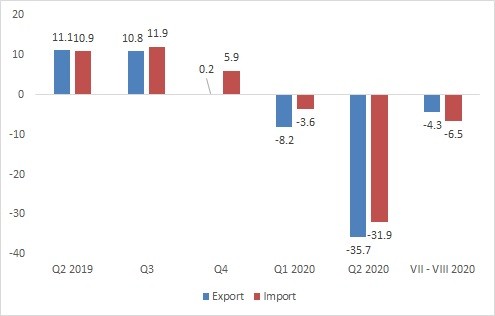

Net exports: Exports and imports of goods in July-August experienced high growth rates. Thus, export of goods increased by 14.1%, while import increased by 13.9% (Graph 5). Given the higher base of imports, net exports are expected to have a negative contribution to GDP growth in Q3 2019.

Private consumption: Private sector lending in July and August continued to grow, but at a slower pace. Thus, the growth in the analyzed period registered growth of 6.7%, which is a slowdown of 2.2 percentage points compared to Q2 of 2019. The increase in the average wage in July by 4.3% and the increase in the gross income based on VAT of 5% in July and August, indicate a positive contribution of private consumption to GDP growth.

Gross investments: We expect a positive contribution to the gross investments to GDP, mainly due to the low base of last year. In addition, there is a high growth in the import of machinery and equipment, as well as growth in the completed construction works. Downward risk is the low level of capital investments realized in the budget of the Republic of Macedonia.

Quarterly Economic Monitor – Projections Q4 – 2019

Macedonia2025 projects: GDP Growth between 1,0% and 3,0% in Q4 2019

Based on the available early warning indicators and high frequency data, we expect moderate slowdown in economic growth in the fourth quarter of 2019.

The projection is due to the following economic developments in the fourth quarter of 2019:

Production side:

Industry: Industrial production recorded a negative growth rate of 1.3% in the fourth quarter of 2019, which represents a negative impulse for GDP growth in the analyzed period. The negative growth rate indicates that the deceleration of the German economy is already observed in the data on industrial production in the Republic of Macedonia. A more detailed analysis indicates that besides the automobile industry, the food and mining industries also recorded negative growth rates. Industrial production risks are still present given the moderate slowdown in the global economy, and in particular the slowdown in our largest trading partner – Germany. Adverse effects are also expected from the economic downturn in China caused by the Covid-19 virus epidemic.

Industrial production data show that industry will have a moderate negative contribution to GDP growth in the fourth quarter of 2019.

Trade: As illustrated in Graph 2, trade continues to record high growth rates in the fourth quarter of 2019, supported by the employment growth, as well as the increase in the average wage. These developments are in line with budget data, which show higher inflows from VAT collection. Higher VAT collection is mainly due to the growth of wholesale trade, while retail trade and motor vehicle sales recorded lower growth rates.

Trends in trade will have a strong positive contribution to GDP growth.

Construction: Construction work decreased by 1% in the period October-November 2019. Despite the Government’s commitment, the low level of capital investment realized in the budget has affected construction as well – an activity that is most severely affected by a lack of work force. Hence, a neutral contribution of construction to GDP growth can be expected for the Q4-2019.

Tourism: As evidenced by Graph 4, tourism in the fourth quarter of 2019 recorded a high growth rate. The number of tourists has seen growth of 15%, while the growth of stays per night has significantly increased by 8%. Such developments, coupled with the growth of catering turnover, suggest that tourism’s contribution to GDP growth may be positive in the fourth quarter of 2019.

Foreign Trade: Export of goods in the fourth quarter of 2019 increased by 0.5%, while import of goods registered a relatively high growth rate of 7.3%. The movements in the quantities are similar. Given these trends, net exports are expected to have a negative contribution to GDP growth in the fourth quarter of 2019.

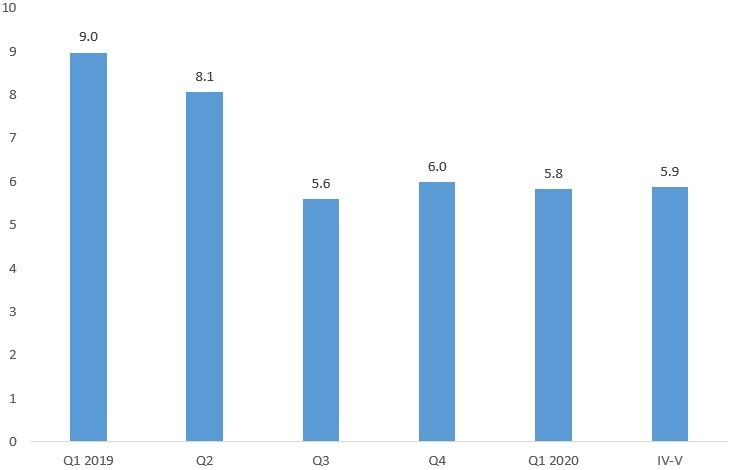

Private consumption: Private sector lending in the fourth quarter of 2019 continued to grow but at a slower pace. Thus, the growth in the analyzed period was 6%, which is a slowdown, compared to the first half of 2019. The increase in average wages as well as the increase in gross income based on VAT indicates a positive contribution of private consumption to GDP growth.

Gross investment: Gross investment growth is expected to slow in the fourth quarter of 2019. The high growth in import of machinery and equipment, which was characteristic of the previous quarters, is already declining, while construction work is also decreasing. Тhe low level of capital investments realized in the central budget is a downward risk.

Quarterly Economic Monitor – Projections Q1 – 2020

Macedonia 2025 forecast: GDP growth in Q1 2020 will be between 2.0% and 4.0%

According to the latest high frequency indicators and available data, moderate deceleration of the economic growth is expected in Q1 2020, compared to the previous quarter.

The projection is due to the following economic developments in Q1 2020:

Production side:

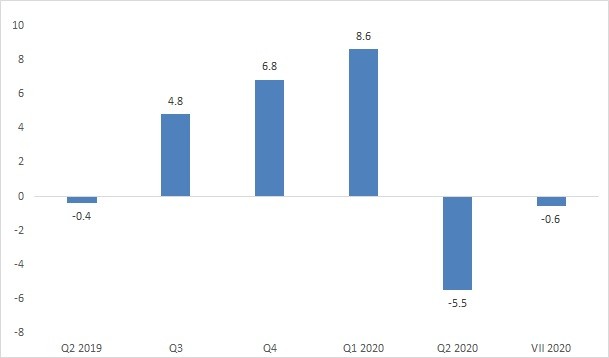

Industrial production: After the decline in the last quarter of 2019, industrial production registered sluggish growth of 1.9% in the first two months of 2020.

This development represents a positive impulse for GDP growth in the analyzed period. A more detailed analysis indicates that the low growth is mostly due to the decline in the utilities sector, while the mining sector and processing industry recorded a solid growth (8.6% and 5.6% respectively). The risks in industrial production are increasing bearing in mind the deceleration of the global economy, especially the slowing down of the economy of our biggest trading partner – Germany.

Higher decrease in industrial production is expected in the third month of 2020.

The data for industrial production indicate that the industry will have a moderate positive contribution to GDP growth in Q1 2020.

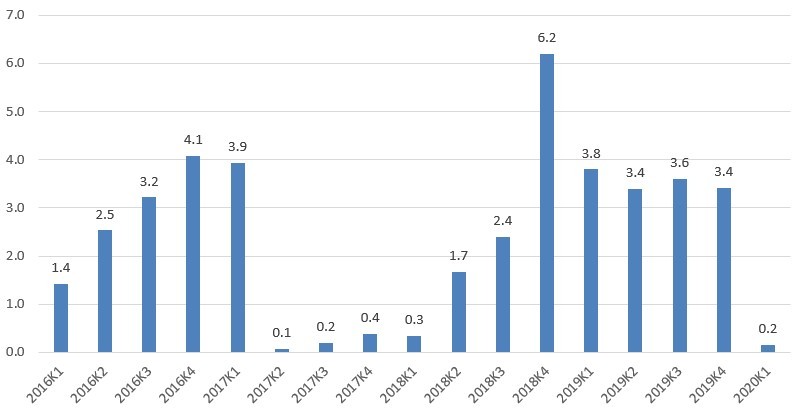

Graph 1: Industrial Production (Annual Growth Rate)

Source: State Statistical Office of the Republic of Macedonia

Trade: As can be seen in Graph 2, the high growth rates of the previous period do not continue into the first quarter of 2020. Total trade fell by 12% between January and February 2020, the decline resulting from a sharp decrease in wholesale trade. At the same time, retail trade recorded a solid growth rate, while the growth rate of motor vehicle trade increased modestly by 3%. Retail trade is currently in line with budget data, which shows a higher inflow of value-added tax (VAT) collection. However, having in mind that the impact of the Covid-19 crisis on the Macedonian economy accelerated in March, further deterioration and higher decline is expected in the trade sector in Q1 2020. Trading patterns and fluctuations will have a strong negative contribution to GDP growth.

Graph 2: Trade Developments (Annual Growth Rate)

Source: State Statistical Office of the Republic of Macedonia

Construction: Completed construction work experienced high growth of 30% in January 2020. The mild winter, as well as the moderate increase of construction activities by the Government of the Republic of Macedonia, had a positive impact on construction in the Republic of Macedonia. Despite the low realization of capital investments in January and February 2020, these investments were nominally higher than last year. Hence, a positive contribution of the construction sector on GDP growth can be expected in the first quarter of 2020.

Graph 3: Completed Construction Works (Annual Growth Rate)

Source: State Statistical Office of the Republic of Macedonia

Tourism: As can be seen from Graph 4, tourism in the first two months of 2020 continued to record solid growth rates. The growth of the number of tourists is 10.5%, while the growth of overnight stays shows a solid increase of 5.1%. Such a positive result is expected to worsen significantly when the State Statistical Office publishes the data for March, given the closure of external borders. These developments, coupled with solid growth in catering turnover (in the first two months, with expectations of a sharp decline in March 2020), point to the possibility that tourism’s contribution to GDP growth will be moderately positive in the first quarter of 2020.

Graph 4: Tourism (Annual Growth Rate)

Source: State Statistical Office of the Republic of Macedonia

Expenditure side:

Foreign trade: Exports of goods in the first two months of 2020 grew by a modest 3.4%, while imports of goods recorded a slightly higher growth rate of 4.9%. Such performance reflects the economic slowdown of our largest trading partner – Germany. Similar developments are observed in quantitative terms. Taking into account such development, as well as the expectations that in March there will be a drastic decline in exports, and probably a larger decline in imports as well, we can expect a moderate negative contribution of net exports for GDP growth in the first quarter of 2020.

Graph 5: Annual Growth Rates of Export and Import

Source: State Statistical Office of the Republic of Macedonia

Private consumption: Lending to the private sector continued to grow in the first two months of 2020. The increase in the average wage (12.3% in January) as well as the growth of gross income on the basis of VAT indicates a positive contribution of personal consumption on GDP growth. However, deterioration is expected in the last month of Q1 2020.

Gross investments: Gross investments are expected to make a positive contribution to GDP in the first quarter of 2020. The main reasons for such expectations are the growth of construction supported by nominally higher capital investments financed through the budget of the Republic of Macedonia, as well as the continuing high growth of imports of machinery and equipment. March dvelopments pose a downwards risk, when a large decline in the imports of machines and equipment is expected.

Graph 6: Private Sector Loans (Annual Growth Rate)

Source: State Statistical Office of the Republic of Macedonia

Economic Growth and Employment in Q1, 2020

The Macedonian economy achieved modest results in Q1 2020, with a GDP growth of 0.2%. Although a deceleration of economic growth was expected, this result is lower than the projections and expectations, including the projections of Macedonia2025. High-frequency data such as trade, construction, foreign trade data, etc., for the months of January-March indicated a higher growth rate of production, especially given that the negative effects began to be felt in the second half of March. The low performance in Q1 2020 is partly due to the higher growth that was achieved in Q1 last year (Figure 1). For comparison, Eurostat data for the 27 EU member states indicate an average GDP decline of -2.5% for the EU member states for the first quarter of 2020. For the countries in the region, data is available only for Serbia where GDP growth in Q1 2020 reached 5%.

Figure 1: Quarterly real GDP growth rates, in %

Source: State Statistical Office of North Macedonia

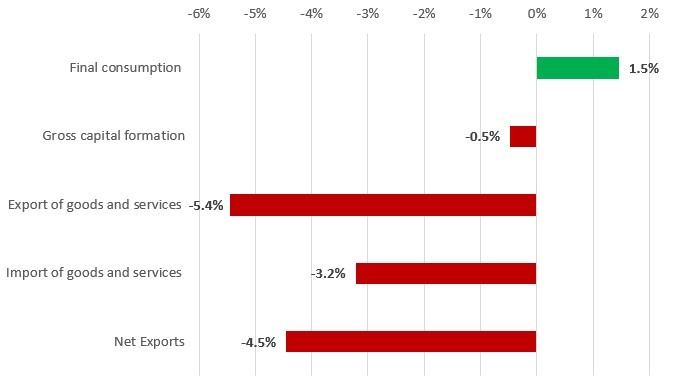

Figure 2 shows the growth rates of the expenditure components of GDP. Only final consumption recorded a positive growth rate of 1.5%, mainly due to a 2.4% increase in public spending, although private consumption also increased by 1.2%. Hence, final consumption is the only positive driver of growth, contributing 1.3 percentage points to the overall growth rate. On the other hand, net exports and gross investment negatively affected economic growth by – 0.9 and – 0.2 percentage points, respectively. This is generally due to the stagnation in international trade as a result of reduced supply and demand for products and services, both in Macedonia as well as in all other countries (and our largest trading partners).

Figure 2: GDP growth rates by expenditure approach, Q1 2020

Source: State Statistical Office of North Macedonia

GDP data by the production approach show that five sectors of the economy recorded a positive growth and contributed to the GDP growth in Q1 2020. Among them, the sectors with the most significant positive effect on GDP are: Real estate activities with 0.8 percentage points contribution to growth and Information and communication with contribution to the added value of 0.7 percentage points. The biggest decline, on the other hand, was recorded by the Mining, Manufacturing, Electricity and Waste management sectors, with a decline in production in Q1 of 5.1% (Figure 3). Although certain segments of trade registered growth in January-March (mostly sectors for production of food and soft drinks), trade as a whole had a negative growth rate in Q1.

Figure 3: Real GDP growth rates by sectors of production, Q1 2020

Source: State Statistical Office of North Macedonia

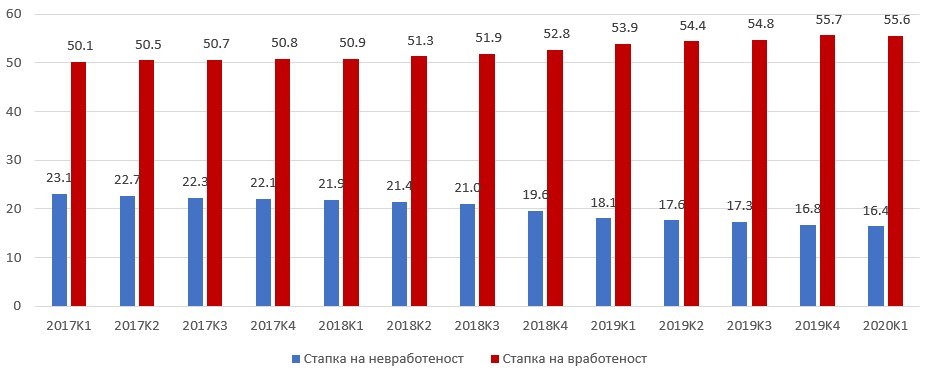

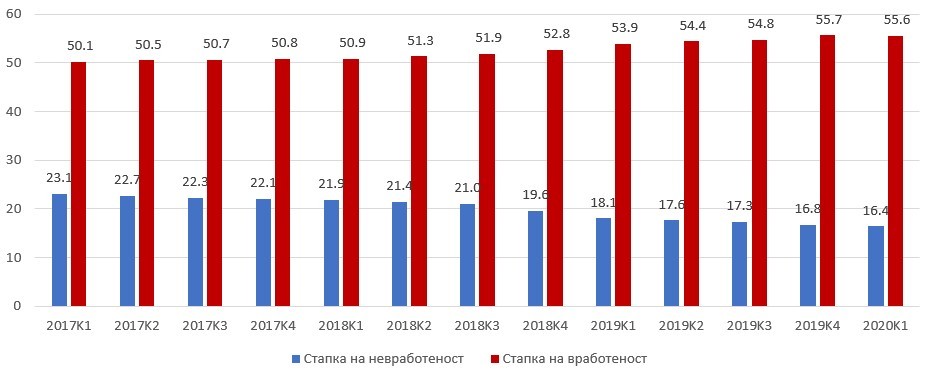

Despite the unfavorable developments of production in Q1 2020, the labor market continued the positive trend. According to the theory and practice, GDP developments (production side) affect employment and the labor market with a certain time lag. As Figure 4 shows, the unemployment rate fell to 16.4% in Q1, from 18.1% a year ago. At the same time, the employment rate increased by 1.7 percentage points to 55.6%, compared to the same quarter last year.

Figure 4: Labor market indicators (population aged 15-64, in %)

Source: State Statistical Office of North Macedonia

According to the projections and forecasts of domestic and foreign economic institutions, and the Government, the largest decline in GDP is expected in the second quarter of 2020, in the period when the crisis intensified, and the strongest restrictive measures for operation of certain industries were in effect.

The government has so far adopted three packages of anti-crisis measures to reduce the negative effects of the pandemic on production, employment and living standards. Macedonia 2025 has prepared three policy contributions as a support and guidance for economic policies, and participated in two projects from the International Labor Organization (ILO) for analyzing the effects of Covid-19 on the economy and offering policy recommendations.

Quarterly economic monitor – projections Q2 – 2020

Macedonia 2025 forecast: The decline in GDP in Q2 2020 will be between 12% and 14%

According to the latest high frequency indicators and available data, we predict the highest decline in the Gross Domestic Product since 1990, as a result of the health and economic crisis.

The projection is due to the following economic developments in Q2 2020:

Production side:

Industrial Production: The negative growth of the industrial production from the first quarter of 2020 continued in the second quarter with an even greater intensity. In particular, the average decline of the industrial production in the first two months of Q2 was 30.2%. This development was expected, given the ongoing health and economic crisis in the world and in Macedonia. A more detailed analysis indicates that the decline is on a broad basis, i.e. a decline is registered in all industries, except the pharmaceutical and chemical industries, as well as the production of computer, electronic and optical products. However, there are slight positive prospects for the industrial production for June, having in mind the gradual re-opening of the Macedonian economy after the first Corona virus wave, as well as the improving outlook of our largest trading partner – Germany.

Industrial production data indicate that industry will have a negative contribution to GDP growth in the second quarter of 2020.

Graph 1: Industrial production, change rates

Source: State Statistical Office of North Macedonia

Trade: Industrial production developments are also reflected in trade. As Graph 2 shows, the high positive rates present in 2019 are discontinued in the first two quarters of 2020. Total trade decreased by 33% in the period April-May 2020, with the decline being due to all three components (retail trade, wholesale trade and motor vehicles), but mostly due to a large decline in the wholesale trade. These developments in the retail trade are in line with the data on tax revenues based on VAT in the government budget, which recorded a similar decline. Considering that the worst period is probably over, improvement is expected in June, i.e. reduction in the negative growth rates of trade. Still, trade developments will have a strong negative contribution to GDP in Q2.

Graph 2: Trade, change rates

Source: State Statistical Office of North Macedonia

Construction: The completed construction works in April 2020 decreased by 14.9% compared to April 2019. However, having in mind that Macedonia is in a pre-election period, for May and June we expect stabilization, i.e. low negative growth rates in the construction sector. Such developments, coupled with the relatively low realization of capital investments in April and May 2020, indicate a negative contribution of the construction sector in the second quarter of 2020.

Graph 3: Completed construction works, change rates

Source: State Statistical Office of North Macedonia

Tourism: As can be seen in Graph 4, tourism in April 2020 marks a complete shutdown/stagnation. Having in mind that the situation was similar in May 2020, we expect the first positive developments to be visible in June 2020. Such developments, supplemented by zero turnover in catering (due to the state-imposed lockdown of restaurants and hotels), indicate a strong negative contribution to GDP.

Graph 4: Tourism, change rates

Source: State Statistical Office of North Macedonia

Expenditure side:

Foreign Trade: The value of exports in April and May of 2020 registered a large decrease of 49.5%, while imports dropped by 43.7%. This data reflects the developments in the real sector, as well as the state of the economy of our largest trading partner – Germany. Volumes of international trade declined by similar rates. Taking this into account, as well as the expectations that in June exports and imports will record slightly lower (but still double-digit) rates of decline, in the second quarter of 2020 we expect a negative contribution of net exports to GDP growth.

Graph 5: Foreign trade, change rates

Source: State Statistical Office of North Macedonia

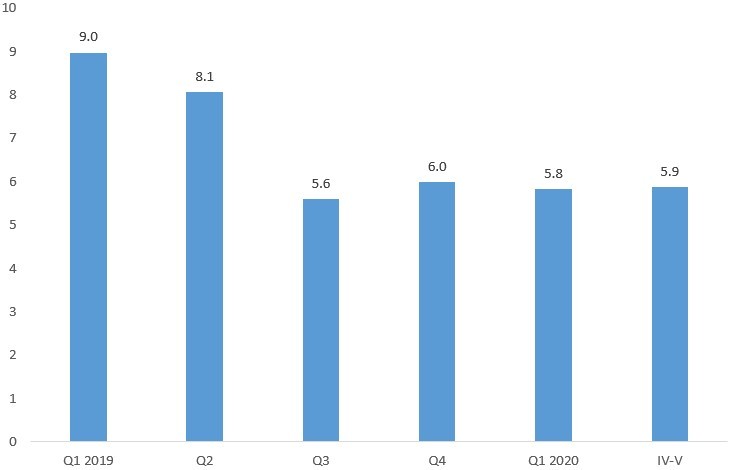

Private consumption: The health and economic crisis has not affected the banking sector. According to the National Bank, lending to the private sector in April and May 2020, unexpectedly, continued to grow with 5.9% on an annual basis. Deposits also showed solid growth, while non-performing loans have not changed significantly. However, the great uncertainty from the health and economic crisis indicates the great restraint of citizens for consumption and a moderate negative contribution of the private consumption to GDP.

Gross investments: The developments in gross investments in the period April-May are in line with other developments in the real sector.

Having in mind that the developments in the construction sector are slightly better than those of the other sectors in the economy, and taking into consideration the current pre-election period in which capital investments financed by the budget usually accelerate, the negative contribution of gross investments in total growth will be moderate. Downward risk are the developments in the import of equipment and machinery, where a decline of 50% was recorded in the analyzed period.

Graph 6: Loans to the private sector, change rates

Source: State Statistical Office of North Macedonia

Quarterly Economic Monitor – Projections Q3, 2020

Macedonia2025 forecast: The decline in GDP in Q3 2020 will be between 4.5% and 6.5%

According to the latest high-frequency indicators and available data so far, we predict a reduction in Gross Domestic Product from 4.5% to 6.5%, as a result of the incomplete recovery of the economy from the consequences of the COVID-19 crisis and the restrictive measures that limit the growth of the economy.

The projection is due to the following economic developments in the third quarter of 2020:

Production side:

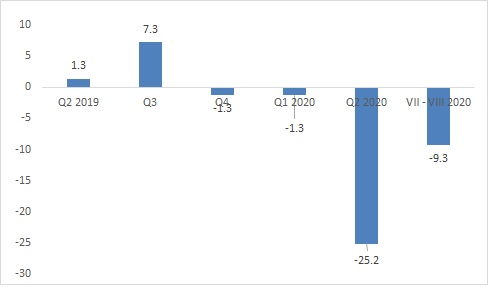

Industrial production: After a sharp decline in the second quarter of 2020, caused by the closure of the economy and the subsequent decline of aggregate supply and demand, industrial production still recorded a negative trend. Namely, in the first two months of the third quarter of 2020, the industrial production declined by 9.3%, although the intensity of the decline is lower than in the previous quarter. This result is due to the partial recovery of the economy and the easing of restrictive measures, as well as the introduced fiscal-monetary measures by the Government and the Central Bank intended for economic recovery. However, the same did not contribute to a full return to normal industrial production. The analysis by individual industries shows a decline in almost all branches except the pharmaceutical facilities, chemical industry, ore production, and the production of computers, electronic and optical products. These industries have proved more resilient to shocks, primarily due to the nature of their sector, and, most importantly, due to the increased demand for their products due to the specific circumstances created by the pandemic, i.e. increased consumption of disinfectants and increased demand for electronic equipment and computers that are necessary due to changes in the way companies, public institutions and health (and education) sector work.

Industrial production data indicate that industry will make a negative contribution to GDP growth in the third quarter of 2020.

Graph 1: Industrial production, annual growth rate

Source: State Statistical Office

Trade:

Data on trade developments continue the negative trend according to the initial data for the third quarter of 2020. As can be seen from Chart 2, we see a subsequent decline in trade volume over the entire period from 2020. Total trade decreased by 25.5% in the period July-August 2020, with the decline due to two of the three components, but mostly wholesale, identical to the second quarter of 2020. We only notice a positive trend in the trade of motor vehicles, which is partly due to a larger purchase order of vehicles for public transport in Skopje. Such data indicate that the recovery from the corona crisis will not occur in the short term as we expected at the beginning of the year, i.e. we expect that trade will have a high negative contribution to GDP decline.

Graph 2: Trade, annual growth rates

Source: State Statistical Office

Construction:

The completed construction works in July 2020 registered a modest decline of 0.6% compared to July 2019. Such developments are more favorable than the data for the previous quarter when we saw a strong negative decline in this sector. Additionally, the capital expenditures in the Budget of the Republic of Macedonia registered a solid growth of about 60%. Taking these indicators into account, as well as the fact that the summer period is the most favorable for the completion of contracted construction works and capital investments, we expect construction to have a positive contribution to GDP growth in the third quarter of 2020.

Graph 3: Completed construction works, annual growth rates

Source: State Statistical Office

Tourism:

As can be seen from Chart 4, tourism in the period July-August 2020 registered lower negative growth rates, but still the situation is still alarming in this sector compared to the same period in 2019. Tourism in the third quarter of 2020 has big issues as a result of restrictive measures from the past period and bans on entry / exit of foreign tourists. Taking into account the data from July-August 2020, and the limited domestic offer of guests, the indications for this sector are with a strong negative growth rate despite the implemented assistance measures. With this in mind, we expect a strong negative contribution to GDP from the Tourism sector.

Graph 4: Tourism, annual growth rates

Source: State Statistical Office

Expenditure side:

Foreign trade:

Exports of goods in July and August of 2020 decreased by 4.3%, while imports of goods had a bigger drop of 6.5%. This is the third consecutive quarterly decline in trade indicators, albeit with lower intensity. The data are also in line with the indicators of our largest trading partners from the EU, where international trade indicators still have a negative growth rate. However, given that imports show a higher decline than exports, we expect the contribution of net exports to be moderately positive.

Graph 5: Foreign trade, growth rates

Source: State Statistical Office

Private consumption:

And in the third quarter of 2020, the banking sector is proving to be resistant to the biggest health and economic crisis that Macedonia (and the world) is experiencing in the last 30 years. According to the data from the National Bank, lending to the private sector in July and August 2020 continued to grow with a solid 6.9% on an annual basis. Deposits also showed solid growth, while non-performing loans did not change significantly. However, the great uncertainty from the health-economic crisis indicates the great restraint of the citizens for consumption and as a result we expect a moderate negative contribution of the private consumption to the GDP for the third quarter of 2020.

Graph 6: Loans to the private sector, growth rates

Source: National Bank of Republic of North Macedonia

Gross Investments:

The developments in the gross investments in the period July-August are relatively better compared to the other movements in the real sector. Long-term corporate loans increased by 13%, capital expenditures in the Macedonian budget increased by 60%, while imports of machinery and transport equipment dropped modestly by 1%. Such data indicate a positive contribution to gross investment in GDP.

Quarterly economic monitor − projections Q2 2022

Macedonia 2025 forecasts: GDP growth in Q 2 2022 will be between 1.5 % and 3.5 %

According to the latest high-frequency indicators and the data available so far, we forecast a positive but relatively low growth of the Gross Domestic Product, i.e. a growth of 1.5% to 3.5%. The main reason for the predicted relatively low economic growth is the war in Ukraine, the high rise in prices at the world level, as well as the disruption of supply chains in the world.

The projection is result of the following economic developments in the second quarter of 2022:

Production side:

Industrial production: In the second quarter of 2022, industrial production recorded a modest increase of 2.9%, which is actually within expectations considering the global challenges faced by the world. Namely, the main reason for the low growth of the industry in the analyzed period is actually the deterioration of the global supply chains, but this time caused in a larger part by the war between Russia and Ukraine and in a smaller part by the prolonged health crisis, especially on the territory of the People’s Republic of China. The analyzed data by individual industrial branches for the second quarter show that the low growth of industrial production is due to the greater part of the increased production in the “Supply of electricity, gas, steam and air conditioning” sector, whereas the processing industry recorded a negative growth rate. Therefore, the decline is mostly due to the traditional sectors – especially the production of metals and food, whereas the production in the automotive industry, that is, among the exporting companies located in the technological development zones, recorded a stable single-digit growth.

Graph No. 1: Industrial production, annual rates of change

Source: State Statistical Office

Industrial production data indicate that industry will have a positive, but low contribution to GDP growth in the second quarter of 2022.

Trade:

As it can be seen in graph 2, a solid increase in the volume of trade is observed in the second quarter of 2022. Namely, the total trade recorded a growth of 13.6%, whereby the growth is due to the positive developments in all three components, and especially as a result of the increase in retail trade. However, this represents a slight slowdown in growth compared to the previous quarter, which is again expected taking into account global developments, especially the war in Ukraine, as well as the global food shortage. The turnover of motor vehicles for the second consecutive quarter recorded a solid double-digit increase, which points to the strengthening of the purchasing power of Macedonian citizens. However, the turnover of motor vehicles is still at a significantly lower level compared to the sale of motor vehicles before the health crisis, i.e. in 2019.

Such trade data indicate that this sector will have a positive contribution to GDP growth, but lower compared to the previous quarter.

Graph No.2: Trade, annual rates of change

Source: State Statistical Office

Construction:

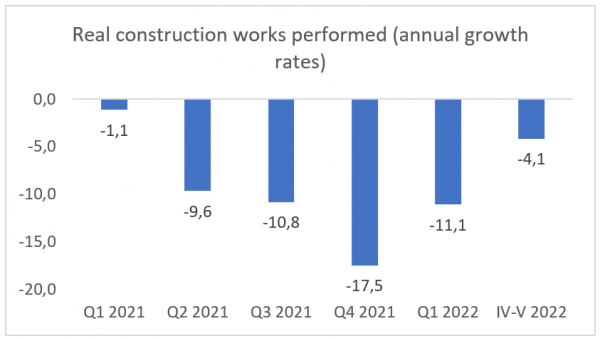

Construction works performed in the period April-May 2022 recorded a real decline of 4.6% compared to the same period of the previous year. Such developments are unfavorable and represent the sixth consecutive quarter of decline in construction in the Republic of North Macedonia. Thus, the decline is significant in low-rise construction, whereas high-rise construction shows an increase. The stagnation in the construction of the Kichevo-Ohrid highway, but also other capital projects, including the Shtip-Kochani road, as well as the weaker implementation of other capital projects throughout the country financed by foreign loans, is the main reason for the deterioration of the figures in the construction sector. On the other hand, in the second quarter of 2022, capital expenditures in the Budget of the Republic of Macedonia recorded a high growth. Such data indicate that construction will have a negative contribution to GDP growth in the second quarter of 2022.

Graph No.3: Construction works performed, annual rates of change

Source: State Statistical Office

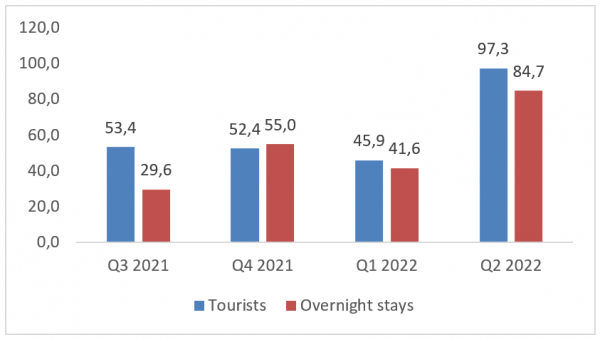

Tourism:

As it can be seen in graph 4, tourism in the second quarter of 2022 recorded a significant improvement in both the number of tourists and overnight stays. The data shows that the improvement is solid and above expectations considering the war in Ukraine, as well as the risks present with the disruption of supply chains. However, the comparison of the nominal numbers of tourists and the number of overnight stays compared to 2019 confirms that it will take more time for this sector as one of the most affected in the Macedonian economy to return to the pre-crisis levels caused by the Covid-19 pandemic and the war in Ukraine.

Taking into account all these data, this sector is expected to have a positive contribution to GDP growth for Q 2 2022.

Graph No. 4: Basic data on tourism, annual rates of change

Source: State Statistical Office

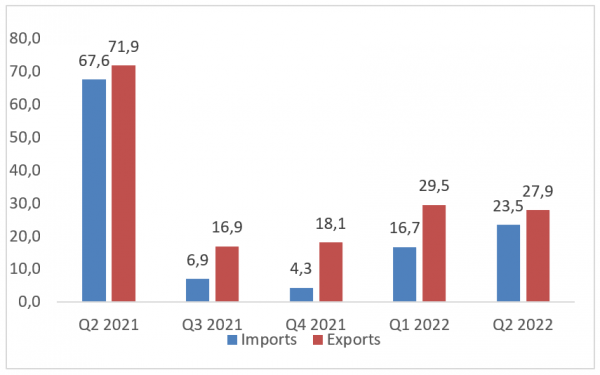

Expenditure side:

Foreign trade exchange: Exports of goods in the second quarter of 2022 recorded a growth of 23.5% compared to the same period last year, whereas imports of goods recorded a greater increase of 27.9%. However, the rise in prices on world markets is the main reason for the high growth of exports and imports. The main contribution to the realizations of exports in this period is the growth of the traditional sectors (iron and steel), the export of energy and food, which is mostly due to the upward developments of the stock exchange prices of these primary products on an annual basis, as well as the growth of exports of the automotive industry.

In terms of imports, energy imports have the highest contribution to growth (under conditions of higher energy prices and simultaneously higher imported quantities). The import of iron and steel, the import of food and consumer goods operated in the same direction. A positive contribution to the growth was also recorded by the raw material import of part of the production facilities in foreign ownership.

Taking into account the growth of exports, but also the higher growth of imports, we expect the contribution of net exports to be negative for Q 2 2022.

Graph No.5: Foreign trade exchange, annual rates of change

Source: State Statistical Office

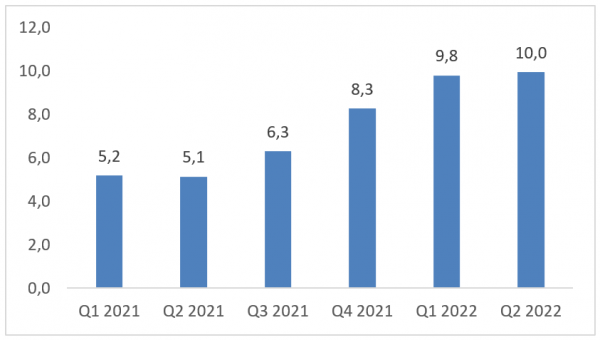

Personal consumption:

Graph 6 shows the changes as of the second quarter of 2022 in the credit activity of the financial sector in the Republic of Macedonia. The intensity of lending shows a solid growth in the second quarter of 2022 as well, which is related to the growth of the average salary, as well as the increase in imports. According to the data of the National Bank, lending to the private sector in the analyzed period continued to grow at a rate of 10% on an annual basis, that is, the fifth consecutive quarter with an acceleration of the growth of both long-term and short-term loans. The measures of NBRM to slow down credit growth through an increase in the base interest rate still do not show a significant impact on lending to the private sector.

At the same time, solid growth was recorded in the citizens’ deposits, as well as the revenues in the Budget based on value added tax. This analysis points to a positive contribution of personal consumption to GDP for the second quarter of 2022.

Graph No. 6: Lending to the private sector, annual rates of change

Source: National Bank of the Republic of North Macedonia

Gross investments:

Positive developments in the second quarter of 2022 are also observed in the gross investments. Long-term loans of enterprises recorded a growth of 9%, and capital investments in the state budget also recorded a high growth. Additional imports of machinery and transport equipment recorded solid growth. Such data point to a solid positive contribution of the gross investments in GDP.

IMF – World Economic Outlook.

In July 2022, the IMF published the new updated World Economic Outlook. The International Monetary Fund expects growth to slow down from 6.1% last year to 3.2% in 2022, which is 0.4 percentage points lower than in April projections. Lower growth earlier this year, reduced household purchasing power and restrictive monetary policy led to a downward revision of 1.4 percentage points to US growth. In China, further problems with Covid-19 as well as a deepening real estate crisis led to growth being revised downwards by 1.1 percentage points, with large global spillovers. And in Europe, the decline in economic growth reflects spillovers from the war in Ukraine and monetary policy. Global inflation has been revised due to the food and energy prices, as well as lingering supply-demand imbalances, and is expected to reach 6.6 percent in advanced economies and 9.5 percent in emerging markets. In 2023, restrictive monetary policy is expected to have moderate negative effects on global output. In terms of risks, IMF experts believe that they are downward, that is, the war in Ukraine could lead to a sudden stop of European gas imports from Russia, and inflation could be harder to reduce than expected.