Quarterly economic monitor − projections Q2 2022

Analysis and publications

Macedonia 2025 forecasts: GDP growth in Q 2 2022 will be between 1.5 % and 3.5 %

According to the latest high-frequency indicators and the data available so far, we forecast a positive but relatively low growth of the Gross Domestic Product, i.e. a growth of 1.5% to 3.5%. The main reason for the predicted relatively low economic growth is the war in Ukraine, the high rise in prices at the world level, as well as the disruption of supply chains in the world.

The projection is result of the following economic developments in the second quarter of 2022:

Production side:

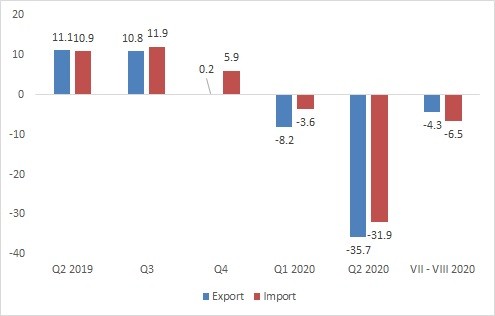

Industrial production: In the second quarter of 2022, industrial production recorded a modest increase of 2.9%, which is actually within expectations considering the global challenges faced by the world. Namely, the main reason for the low growth of the industry in the analyzed period is actually the deterioration of the global supply chains, but this time caused in a larger part by the war between Russia and Ukraine and in a smaller part by the prolonged health crisis, especially on the territory of the People’s Republic of China. The analyzed data by individual industrial branches for the second quarter show that the low growth of industrial production is due to the greater part of the increased production in the “Supply of electricity, gas, steam and air conditioning” sector, whereas the processing industry recorded a negative growth rate. Therefore, the decline is mostly due to the traditional sectors – especially the production of metals and food, whereas the production in the automotive industry, that is, among the exporting companies located in the technological development zones, recorded a stable single-digit growth.

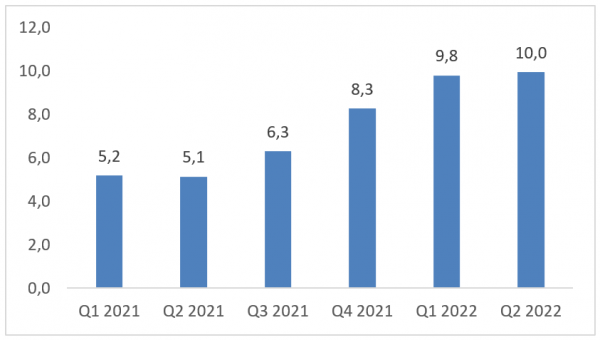

Graph No. 1: Industrial production, annual rates of change

Source: State Statistical Office

Industrial production data indicate that industry will have a positive, but low contribution to GDP growth in the second quarter of 2022.

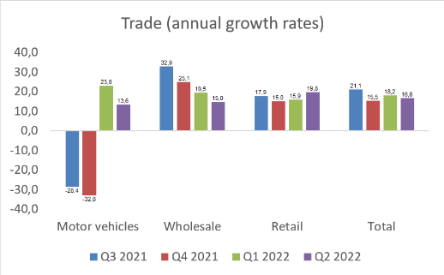

Trade:

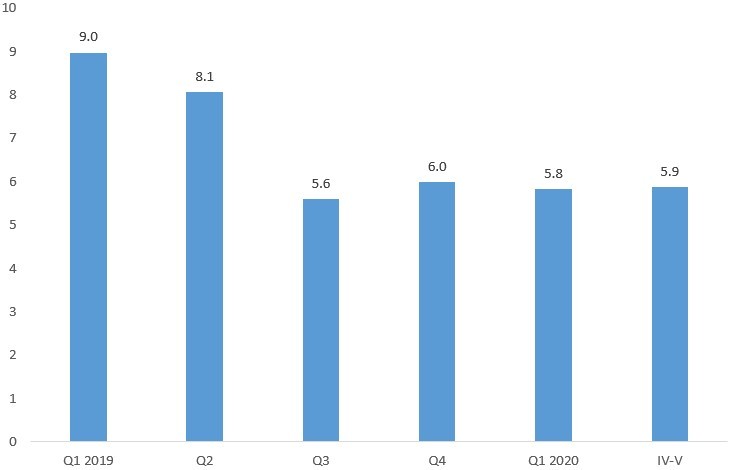

As it can be seen in graph 2, a solid increase in the volume of trade is observed in the second quarter of 2022. Namely, the total trade recorded a growth of 13.6%, whereby the growth is due to the positive developments in all three components, and especially as a result of the increase in retail trade. However, this represents a slight slowdown in growth compared to the previous quarter, which is again expected taking into account global developments, especially the war in Ukraine, as well as the global food shortage. The turnover of motor vehicles for the second consecutive quarter recorded a solid double-digit increase, which points to the strengthening of the purchasing power of Macedonian citizens. However, the turnover of motor vehicles is still at a significantly lower level compared to the sale of motor vehicles before the health crisis, i.e. in 2019.

Such trade data indicate that this sector will have a positive contribution to GDP growth, but lower compared to the previous quarter.

Graph No.2: Trade, annual rates of change

Source: State Statistical Office

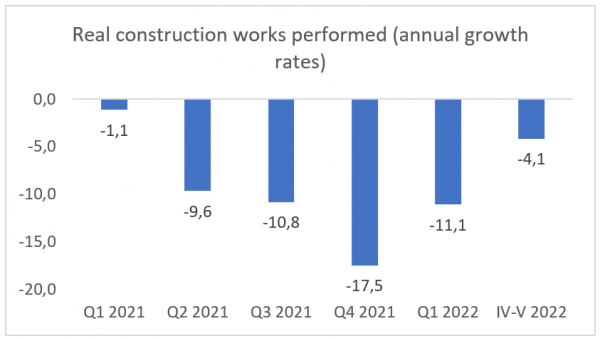

Construction:

Construction works performed in the period April-May 2022 recorded a real decline of 4.6% compared to the same period of the previous year. Such developments are unfavorable and represent the sixth consecutive quarter of decline in construction in the Republic of North Macedonia. Thus, the decline is significant in low-rise construction, whereas high-rise construction shows an increase. The stagnation in the construction of the Kichevo-Ohrid highway, but also other capital projects, including the Shtip-Kochani road, as well as the weaker implementation of other capital projects throughout the country financed by foreign loans, is the main reason for the deterioration of the figures in the construction sector. On the other hand, in the second quarter of 2022, capital expenditures in the Budget of the Republic of Macedonia recorded a high growth. Such data indicate that construction will have a negative contribution to GDP growth in the second quarter of 2022.

Graph No.3: Construction works performed, annual rates of change

Source: State Statistical Office

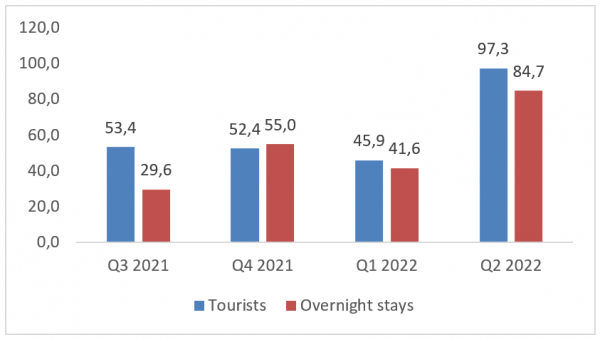

Tourism:

As it can be seen in graph 4, tourism in the second quarter of 2022 recorded a significant improvement in both the number of tourists and overnight stays. The data shows that the improvement is solid and above expectations considering the war in Ukraine, as well as the risks present with the disruption of supply chains. However, the comparison of the nominal numbers of tourists and the number of overnight stays compared to 2019 confirms that it will take more time for this sector as one of the most affected in the Macedonian economy to return to the pre-crisis levels caused by the Covid-19 pandemic and the war in Ukraine.

Taking into account all these data, this sector is expected to have a positive contribution to GDP growth for Q 2 2022.

Graph No. 4: Basic data on tourism, annual rates of change

Source: State Statistical Office

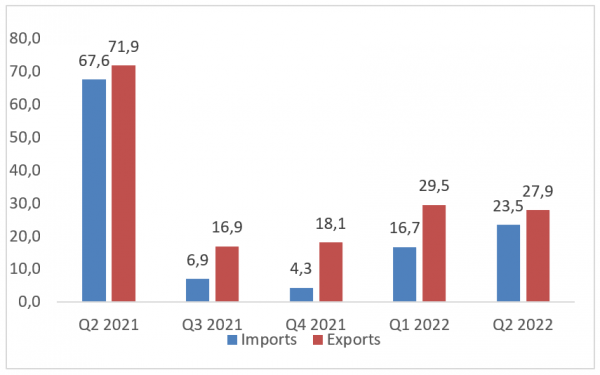

Expenditure side:

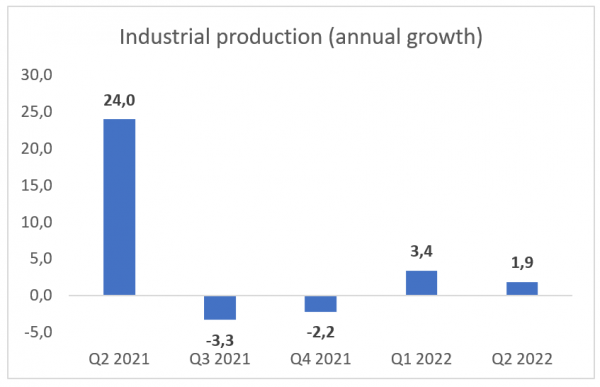

Foreign trade exchange: Exports of goods in the second quarter of 2022 recorded a growth of 23.5% compared to the same period last year, whereas imports of goods recorded a greater increase of 27.9%. However, the rise in prices on world markets is the main reason for the high growth of exports and imports. The main contribution to the realizations of exports in this period is the growth of the traditional sectors (iron and steel), the export of energy and food, which is mostly due to the upward developments of the stock exchange prices of these primary products on an annual basis, as well as the growth of exports of the automotive industry.

In terms of imports, energy imports have the highest contribution to growth (under conditions of higher energy prices and simultaneously higher imported quantities). The import of iron and steel, the import of food and consumer goods operated in the same direction. A positive contribution to the growth was also recorded by the raw material import of part of the production facilities in foreign ownership.

Taking into account the growth of exports, but also the higher growth of imports, we expect the contribution of net exports to be negative for Q 2 2022.

Graph No.5: Foreign trade exchange, annual rates of change

Source: State Statistical Office

Personal consumption:

Graph 6 shows the changes as of the second quarter of 2022 in the credit activity of the financial sector in the Republic of Macedonia. The intensity of lending shows a solid growth in the second quarter of 2022 as well, which is related to the growth of the average salary, as well as the increase in imports. According to the data of the National Bank, lending to the private sector in the analyzed period continued to grow at a rate of 10% on an annual basis, that is, the fifth consecutive quarter with an acceleration of the growth of both long-term and short-term loans. The measures of NBRM to slow down credit growth through an increase in the base interest rate still do not show a significant impact on lending to the private sector.

At the same time, solid growth was recorded in the citizens’ deposits, as well as the revenues in the Budget based on value added tax. This analysis points to a positive contribution of personal consumption to GDP for the second quarter of 2022.

Graph No. 6: Lending to the private sector, annual rates of change

Source: National Bank of the Republic of North Macedonia

Gross investments:

Positive developments in the second quarter of 2022 are also observed in the gross investments. Long-term loans of enterprises recorded a growth of 9%, and capital investments in the state budget also recorded a high growth. Additional imports of machinery and transport equipment recorded solid growth. Such data point to a solid positive contribution of the gross investments in GDP.

IMF – World Economic Outlook.

In July 2022, the IMF published the new updated World Economic Outlook. The International Monetary Fund expects growth to slow down from 6.1% last year to 3.2% in 2022, which is 0.4 percentage points lower than in April projections. Lower growth earlier this year, reduced household purchasing power and restrictive monetary policy led to a downward revision of 1.4 percentage points to US growth. In China, further problems with Covid-19 as well as a deepening real estate crisis led to growth being revised downwards by 1.1 percentage points, with large global spillovers. And in Europe, the decline in economic growth reflects spillovers from the war in Ukraine and monetary policy. Global inflation has been revised due to the food and energy prices, as well as lingering supply-demand imbalances, and is expected to reach 6.6 percent in advanced economies and 9.5 percent in emerging markets. In 2023, restrictive monetary policy is expected to have moderate negative effects on global output. In terms of risks, IMF experts believe that they are downward, that is, the war in Ukraine could lead to a sudden stop of European gas imports from Russia, and inflation could be harder to reduce than expected.

Related